Case Study: Mini-Case: Ford Stockholders’ Equity

Case study: Mini-Case: Ford Stockholders’ Equity.

Using the statements attached, please answer the following questions:

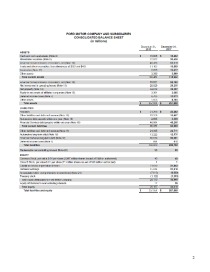

1.Shares issued

a.How many shares of common stock were authorized at fiscal year-end 2017?

b.How many shares of stocks were issued as of fiscal year-end 2017?

c.How many types of stocks does Ford have? What is the difference between them?

2.Common stock

a.What is the par value of each share of common stock issued?

b.at is the total par value of all common shares issued as of the end of 2017?

c.How much money in excess of the par value of the stock had been contributed by shareholders?

3.Treasury stock

a.How many shares were outstanding at the end of 2017?

b.How much did Ford pay for the Treasury Stock it held at the end of 2017?

c.How much cash did Ford pay to repurchase its own shares during 2017?

4.Issuance of stock

a.What was the total value of the shares issued by Ford during 2017 (including shared-based compensation impacts)?

5.Dividends

a.How much did Ford declare in dividends during 2017?

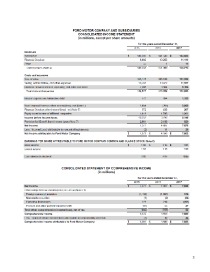

6.Earnings per Share

a.What was the Basic net income per share?

b.What was Diluted EPS for 2017?

c.When would you expect diluted EPS to be very different from basic EPS?

7.Comprehensive Income

a.During 2017, did Ford shareholders gain or lose wealth as a result of items that were reported in “comprehensive income” but were not included in net income?

- Accounting Term papers

- Microsoft Word 1069 KB

- 2021 m.

- English

- 6 pages

- University

- Lanni