Capital Structure

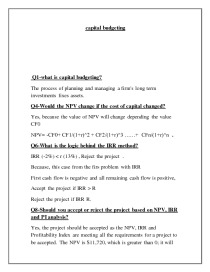

Capital budgeting. Q1-what is capital budgeting? Q4-Would the NPV change if the cost of capital changed? Q6-What is the logic behind the IRR method? Q8-Should you accept or reject the project based on NPV, IRR and PI analysis?

Yes, the project should be accepted as the NPV, IRR and Profitability Index are meeting all the requirements for a project to be accepted. The NPV is $11,720, which is greater than 0; it will bring cash flows inflows into the business. The IRR is greater than the discount rate of 10%, which again shows it is a good investment. The Profitability Index is $1.117, and a project can be accepted if it's greater than 1. Therefore, the project is profitable and should be implemented.

- Accounting Analysis

- Microsoft Word 11 KB

- 2019 m.

- English

- 2 pages (200 words)

- University

- Nader