Enterprice Financial Management Presentation

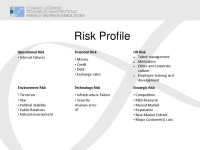

Enterprice Financial Management. Enterprise Risk Management. Risk Profile. Risk management requires certain degree of centralization. Derivatives (derivative securities). The derivative - security whose market value is directly related to. Derivatives. Reasons to use derivatives Speculation Hedging. Option contract An. Futures contract A. The primary difference. Forward contract. Swap contracts. A derivative through which two parties exchange financial instruments. Derivative Markets. Provide payoffs that depend on the values of other assets such as commodity prices. Put Options A put. Call Options A call. Participants in the. Buy - holders. Types of options American – can be exercised any time untill its expiration date. Thank you for your attention.

Swap contracts. A derivative through which two parties exchange financial instruments, usually cash flows or interest rates for a certain period of time.Most common are interest rate swaps. Swaps are not traded on exchange market. Usually used between financial institutions and businessess.

Buy - holders (long positions) Sell - writers (short positions) Holders (buyers) are not obligated to buy or sell (for an option contract). Writers (sellers) are obligated to buy or sell (for an option contract).

- Economy & Finance Presentations

- MS PowerPoint 196 KB

- 2018 m.

- English

- 18 pages (565 words)

- College

- Vilma